Login Guide

www.atlanticfcu.com – How to Access Atlantic Federal Credit Union Account

Login Guide for Atlantic Federal Credit Union Account:

You are imperative to them. As a philanthropic establishment, they exist exclusively for your prosperity. Rather than stashing benefits, they use them to get better rates and other first in class administrations.

Also, as a part, you’re not simply one more client. You’re a partner in our establishment with a say in all that they do. Thus, they might want to thank you for assisting them with getting where they are today.

About Atlantic Federal Credit Union:

- They’re eager to assist individuals and organizations succeed monetarily, yet that is not everything they do.

- They likewise assume a functioning part in the networks they serve.

- They accept cash isn’t the end, however the way to carry on with a remunerating life.

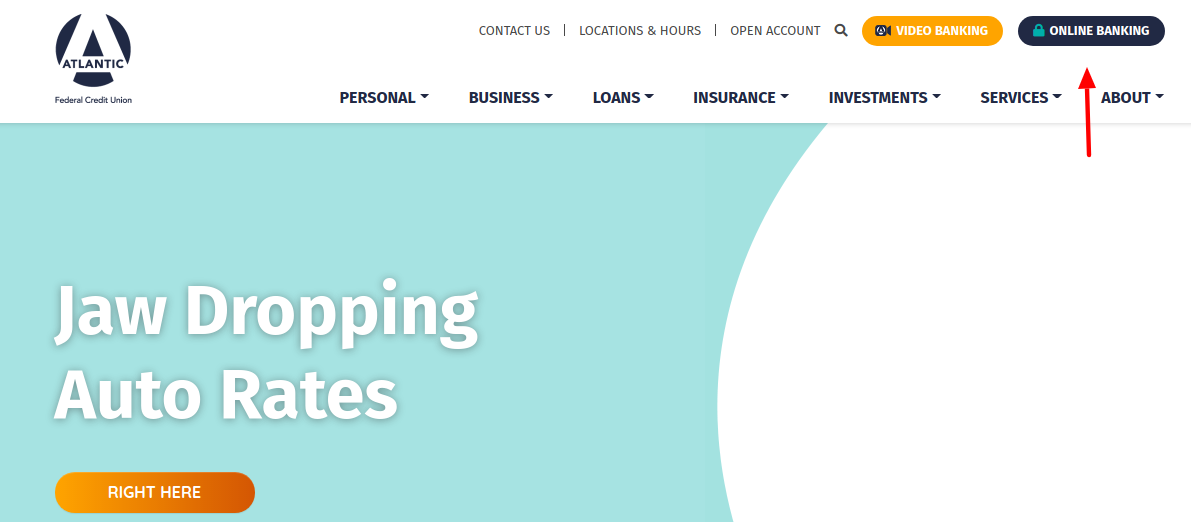

Atlantic Federal Credit Union Log In:

- To login open the page www.atlanticfcu.com

- After the page opens at top right click on the ‘Online banking’ button.

- In the login widget provide the required information hit on the ‘Log in’ button.

How to Retrieve Atlantic Federal Credit Union Log In Details:

- To retrieve the login details open the page www.atlanticfcu.com

- As the page appears in the login widget hit on ‘Forgot username’ button.

- You will be forwarded to the next screen enter the account number, SSN, birthday, password hit on ‘Start’ button.

- For password reset enter the required information hit on ‘Start’ button.

Register for Atlantic Federal Credit Union Account:

- To register for the account open the page www.atlanticfcu.com

- As the page opens in the login widget click on ‘Enroll-now’ button.

- You have to provide account number, SSN, date of birth, check the verification code hit on ‘start’ button.

Also Read : Steps ot Access Ohio Lottery Online Account

Boost Your Credit Score:

- Pay Back Your Obligations On Schedule: How you’ve reimbursed past obligation is the main factor in computing your financial assessment. Watch this snappy video on Payment History.

- Apply for New Credit Just When You Need It: 10% of your FICO assessment is dictated by the number of new credit accounts you’ve opened and the occasions moneylenders have checked your credit. Another 15% of your score is controlled by the length of your record. At the point when you add another record in with the general mish-mash, the normal age of your credit accounts drops.

- Don’t Co-Sign: Be wary about co-marking an advance, in any event, for relatives, except if you are willing and ready to take on the installments later, if important. On the off chance that an installment is missed and you don’t pay it, it can contrarily influence your FICO rating.

- Consider Keeping Starter Cards Open: Cards intended for individuals without a record as a consumer, called starter cards, generally have high loan costs and charges, low cutoff points and few prizes. Despite the fact that you’ve quit utilizing them, it’s a smart thought to keep them open. This will help the 15% of your score that comes from the length of your record.

- Gatekeeper Your Own Data: Be cautious when giving out your MasterCard numbers, Social Security number, birth date, and other individual data. Utilize secure sites and be careful on calls. Try not to leave administrative work with this data on it lying around shred it.

- Consistently Screen Every One of Your Records: Even in the event that you don’t utilize them, check each record to ensure there aren’t charges, like yearly expenses, and that nobody is deceitfully utilizing your card. Request a free credit report from annualcreditreport.com, the lone site endorsed by the Federal Trade Commission.

- Stay Steady: Make sure that the great FICO assessment you’ve endeavored to fabricate stays that way. In expansion, in the event that you are hoping to construct your credit and increment your score, think about a Credit Builder Loan with Atlantic.

- Your Credit Score: Your FICO rating is a three-digit number that leasers use to survey that you are so liable to reimburse your advances. A high score can assist you with qualifying the most reduced financing costs and enables you to get cash for buys.

Atlantic Federal Credit Union Customer Help:

For more help options call on (800) 834-0432.

Reference Link:

-

Finance4 weeks ago

Finance4 weeks agoHow to Apply for Student Finance UK Online

-

Login Guide4 weeks ago

Login Guide4 weeks agooffice.com/verify – Signin to Download and Set up MS Office

-

Internet4 weeks ago

Internet4 weeks agowww.gaia.com/activate – Actiavtion Guide for Gaia app on your Devices

-

Login Guide4 weeks ago

Login Guide4 weeks agoHow to connect the Search console with your free WordPress account Without any Plugin in 2023

-

Login Guide4 weeks ago

Login Guide4 weeks agoHow to Access Edulastic Student Account @app.edulastic.com

-

Login Guide4 weeks ago

Login Guide4 weeks agoHow to Login to your Lifeworks Online Account