Internet

www.forwardline.com/activate – Activate Forwardline Account Online

Activate Forwardline that can fuel your business:

Whether it is a person or industry nobody has been spared by the Covid-19 pandemic. It is the natural reason to lose hope if you are in a tremendous financial deficit or your small business has been hardly hit by the pandemic situation. So, in this situation, you can fuel your business by completing a no-obligation application form at www.forwardline.com/activate.

Forwardline is always here to help you. They will help you as a direct leader to find the right funding solution for your business. They have made applying easier than ever with their short application. Here is complete guideline about the activation procedure of forwarding.

Features and benefits of Forwardline:

- They offer short-term loans to small businesses that have been in operation for at least three years.

- For doing most of the work for the application process, forwardline relies on technology and For Sight algorithm so that it will take much less time on a Forwardline application than with other online lenders and traditional financing institutions.

- Forwardline is always there to determine whether your business has been stable and will be strong enough in the future to pay them back through taking a more holistic look at all the data.

- In forwardline business loans are offered with relatively affordable rates.

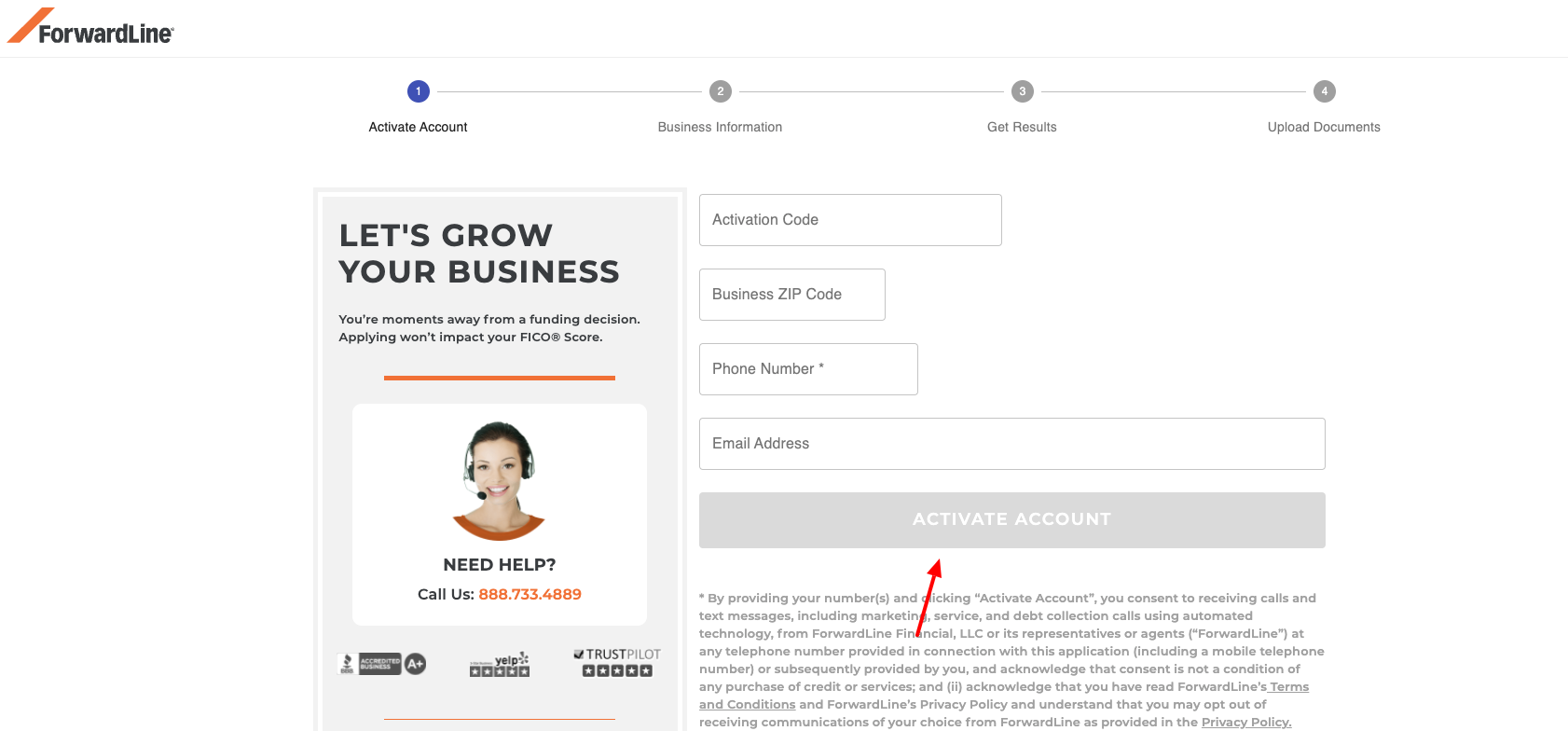

How to Activate Forwardline:

Forwardline can be activated through online and easy effective activation procedure. For this, you have to follow these simple steps to activate forwardline.

- First you have to visit the official website of Forwardline www.forwardline.com

- Then you have to click on the activate now button at the center of the home page.

- Then the main activation page will appear, or directly go to the www.forwardline.com/activate page

- Then there you have to enter 16-digit Activation Code, Business ZIP Code, Phone Number, and Email Address in the fields provided.

- Then click on the activate account option.

- Then business information page will appear.

- You have to provide all information required and complete the process.

- Similarly, you have to complete the Get results and documents uploads page with correct informations.

- One of the authorized personnel will review your application and will contact you via the registered email address or phone number.

- You will receive funds right into your bank account after approval.

Business loans of Forwardline:

Business loans with relatively affordable rates are offered by Forwardline. For keeping their rates affordable, they have strict quality standards to ensure the borrower is a good fit and works with a very specific type of borrower.

- Short Term Loans:

- Maximum loan amount: up to $150,000

- Loan term: 6 – 15 months

- Interest rate: 15.50% – 34%

- Short term loan qualifications:

- Annual Revenue: $50,000

- Personal credit score: 500

- Time in business: 2 years

Apply Forwardline funding:

If you want to apply for forwardline funding you are in the right place. Go through these points below for applying.

- First, you have to visit the official website of forwarding apply.forwardline.com/merchant

- Then you have to complete the application with certain basic details.

- You have to mention your time of mention whether it is 0 – 11 months, 12 -23 months, 24 – 35 months, etc.

- Then provide information about gross annual sales Less than $49,000, $50,000 – $74,999, $75,000 – $99,999, etc. and Amount Request which must be between $5,000 and $2,000,000 and about your Industry like Gas Station, Flower Shop, Dry Cleaner, Distributor, Construction, Furniture, Entertainment, etc.

- You have to provide your business name, email, address, ZIP, City, State, etc.

- Then you have to click on the continue button.

- Then you have to proceed with two other stages “Get results” and “Upload documents”.

- Follow the instructions as directed.

- Then they will assign you a code which will come in handy in the later part when you access the www.forwardline.com/activate link to complete the procedure.

Eligibility criteria for Forwardline borrowers:

You must check the eligibility criteria if you want to borrow a loan from forwardline.

- Business related instructions:

- 100% wholesale businesses will not be eligible.

- Used automobile dealers, real estate agents, or pawn shops operating businesses will not be eligible.

- Adult entertainment, marijuana, lending, or money services industry will not eligible.

- Other than home address operating businesses will not eligible.

- Financial matter related instructions:

- An average bank balance of $1,000 is required.

- You must have a minimum of seven monthly deposits in your personal or business bank account in order to qualify.

- Businesses that have more than $50,000 in a tax lien will not be funded by forwardline.

- ForwardLine will need to see that the borrower is on a payment plan If the borrower has a tax lien below $50,000.

- Borrowers with more than three NSF (non-sufficient funds) days in one month will not be funded by forwardline.

- Previously bankrupt borrowers can only get loans from forwardline.

- Owner of a business that owns more than 70% will be eligible.

- For the purpose of refinancing debt, but only if the financing has occurred at least 90 days ago and the existing balance has been paid down by at least 50% forwardline will give loan.

Also Read: Rooster Teeth Activate Online

Documents required to apply for forwardline:

- You have to provide 3 months business bank statements

- Voided check of business should be provided.

- Valid driver license copy is needed.

Repayment to forwardline:

- Forwardline set you up to pay a small amount each day, via ACH if you accept your offer from Forwardline.

- For a short-term working capital loan from Forwardline, you’ll have to pay a fixed daily amount for your given term length.

- For one of their merchant cash advance products, you have to pay fixed percentage of your daily credit card sales until they’ve collected in full.

- The daily payments will be small which will be automatically deducted from your bank account.

- The day after you’re funded the first payment will be debited.

Customer Service:

The customer service of forward line is available through phone and mail 24hrs a day.

You can contact their customer support representatives,

at (866) 623-4900 on Monday through Friday from 6:00 a.m. to 5 p.m. PST and Saturday and Sunday closed.

3000 Olympic Blvd

Bldg 4

Santa Monica, CA 90404

Reference:

-

Finance2 weeks ago

Finance2 weeks agoHow to Apply for Student Finance UK Online

-

Login Guide1 week ago

Login Guide1 week agooffice.com/verify – Signin to Download and Set up MS Office

-

Internet1 week ago

Internet1 week agowww.gaia.com/activate – Actiavtion Guide for Gaia app on your Devices

-

Login Guide2 weeks ago

Login Guide2 weeks agoHow to connect the Search console with your free WordPress account Without any Plugin in 2023

-

Login Guide1 week ago

Login Guide1 week agoHow to Access Edulastic Student Account @app.edulastic.com

-

Login Guide2 weeks ago

Login Guide2 weeks agoHow to Login to your Lifeworks Online Account