Credit Card

www.barclaycardus.com – How to Manage your Barclays Credit Card Account

How to Login, Apply, and Activate your Barclay’s Card:

Barclays US, backed by Barclays was launched on 29th June 1966 as a charge card. they became the first credit card in the U.K. on 8th November 1967. They are known as transatlantic consumer and wholesale banks with a global reach. They may not have branches but have deep roots. They are part of a network of 85,000 people strong who move, lend, invest and protect money for customers and clients across 40 countries.

They collaborate with over 25 top companies to deliver an array of consumer and small business credit card programs to fit any lifestyle in the US market. your personal finances are always handy—from credit cards to savings, CDs, and loans with this digital banking platform. They also offer simple tools that make it easy to plan, and there’s always a real person ready to help you when you need it.

Barclay’s card features:

- Most of the no-annual-fee Barclaycard cards come with a signup bonus.

- Every Barclaycard product is a rewards card.

- From Barclay’s you will get more travel cards than perhaps any other provider.

- They will also offer niche travel card offerings, such as resort credit cards and cruise credit cards.

- You will find a signup bonus with each card.

- Barclaycard’s general travel cards provide best bonuses.

- They also offer a variety of unusual cobranded cards, including cards for the NFL.

Barclays Classic chip debit card benefits:

With this Barclays Classic chip debit card, you can take your bank with you wherever you go. This chip-based VISA debit card has some enhanced security features making all transactions safe and hassle-free. This will open up a world of endless exciting benefits and offers for you.

- If you want to conveniently shop in a local store or the international market, with Barclay’s debit and credit cards you can shop at your favorite store.

- If you are traveling overseas and need instant help then you can always avail of yourself the comprehensive VISA Global Customer Assistance Service.

- You must be sure that your transactions are safe, Barclays cards come equipped with a chip.

Types of Barclays Cards:

If you are confused to choose which card then here you can get an array of popular cards that would just fit in almost everything – travel, retail, entertainment, every day, cashback, and business expenses offered by Barclay’s.

- Choice Privileges (VISA Signature Card): $0 annual fee

- Priceline Rewards (VISA card): $0 annual fee

- Holland American Line (Rewards VISA Card): $0 annual fee

- Hawaiian Airlines (World Elite Business Mastercard): $99 annual fee

- Hawaiian Airlines (World Elite Mastercard): $99 annual fee

- AAdvantage Aviator (World Elite Business Mastercard): $95 annual fee

- JetBlue (Business Card): $99 annual fee

- NFL Extra Points (Credit Card): $0 annual fee

- Carnival (Mastercard): $0 annual fee

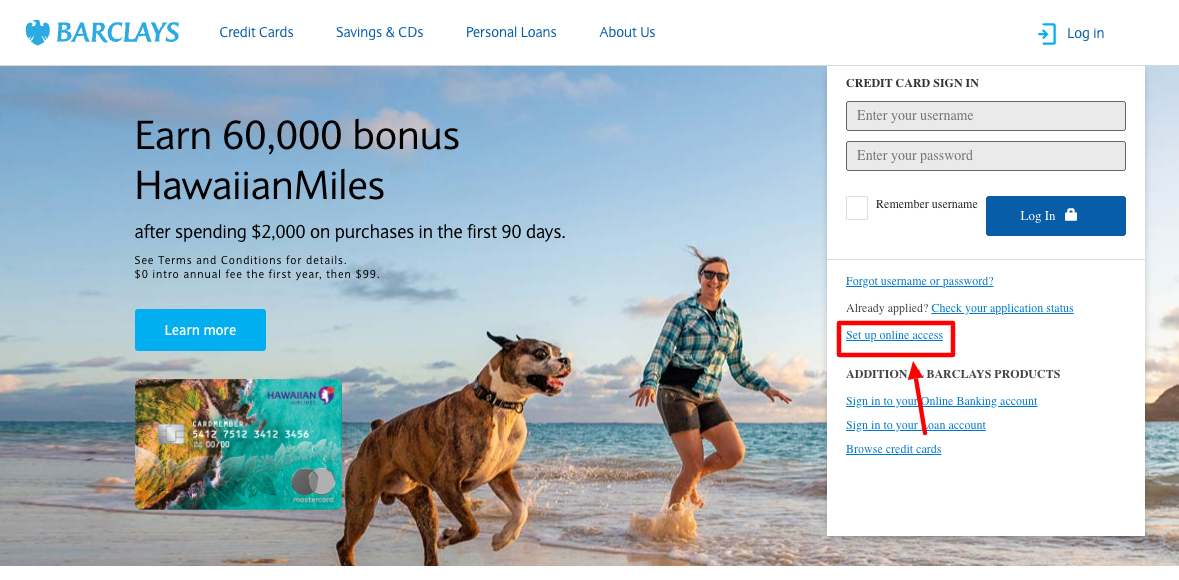

Barclay’s card Apply:

If you want to apply for Barclay’s Card then follow these simple steps to apply online.

- First, you have to visit Barclay’s website www.barclaycardus.com

- Select among the credit cards available.

- Then click on Set up online access tab.

- Then you will be redirected to a new website where you have to fill up a form.

- Provide accurate pieces of information about your employment and financial status.

- Finally, you have to review the fees associated with the credit card of your choice.

- Anyone can submit this application but the decision will depend on the applicant’s financial portfolio.

Eligibility for Applying for Barclay’s card:

Applicants need to satisfy the following requirements by the bank to become a successful Barclay’s cardholder.

- Applicants must have Barclay’s online account.

- You must have a phone number.

- Applicants must be over 18 years of age to use the Barclays app.

- You must be earning over £3,000 a year.

- You must not be bankrupt or had an Individual Voluntary Arrangement or Debt Relief Order in the last six years.

- You must not have any outstanding County Court Judgement (CCJ’s) in the last six years.

- You must have proof of your current address.

- You need to have a good record of paying bills on time.

Fees and Charges:

- You’ll be charged a fee of £12 if you miss or do not pay your minimum payment amount. You will be charged a late payment fee no more than four times in a year.

- You will be not charged any interest on default fees for 28 days starting from the time. You will charge interest on your default fee at your standard rate after 28 days.

- For non-sterling purchase fee of 2.99% every time. You will be charged a cash transaction fee of 2.99% (minimum fee of £2.99).

Barclay’s Card Activation:

Online method

You will need to have an online account first if you choose to activate your card online. But if you don’t have an online account then first sign up with details required i.e., bank account details, social security number and date of birth. Once you get online access, follow these steps to activate your card.

- First you have to switch on your computer or laptop.

- Then launch your browser.

- You have to visit the official website of Barclays.

- Then find the option “Activate Your Card Online”.

- Then the Activation page will appear.

- After that tap on “Login to activate” and get redirected to the log-in page.

- You have to provide your “Username or ID number”.

- Then tap on the “Next” button.

- You have to provide the password and follow the on-screen instructions to activate this card.

For Android users:

If you want to activate your card using your android phone then follow these steps.

- You have to visit the “Google Play Store” on your phone.

- Then find the Barclaycard app there.

- After that, you have to install the app on your device.

- Launch the app on your android device.

- You will need to Sign in using Barclays Account credentials.

- You will need your card details and follow the on-screen instructions to activate it.

For iOS users:

If you are an Apple device user you can follow these steps to activate your card.

- First, you have to switch on your iPhone.

- Then visit the App Store.

- You have to find the Barclaycard app and install the same in your device.

- launch the app in your device.

- You have to sign-in using the credentials.

- You will also need your card details to complete the activation process.

Through Barclay’s app:

You have to check these steps to activate the card using your Barclay’s Card.

- First you have to install the Barclaycard app on your smartphone.

- You have to log in.

- Then press the option “Barclaycard”.

- Your card has been activated.

- Now you can manage your account as well.

Benefits of Online Banking:

You can have some great advantages if you have an online account with Barclay’s card. You must check out these features before creating a Barclays online account.

- With online banking, you can check balances, transfer money and pay bills.

- You will be able to view and download statements.

- It will be easy to manage Direct Debits and standing orders.

- You can view your debit card PIN.

- You can easily report a lost or stolen card.

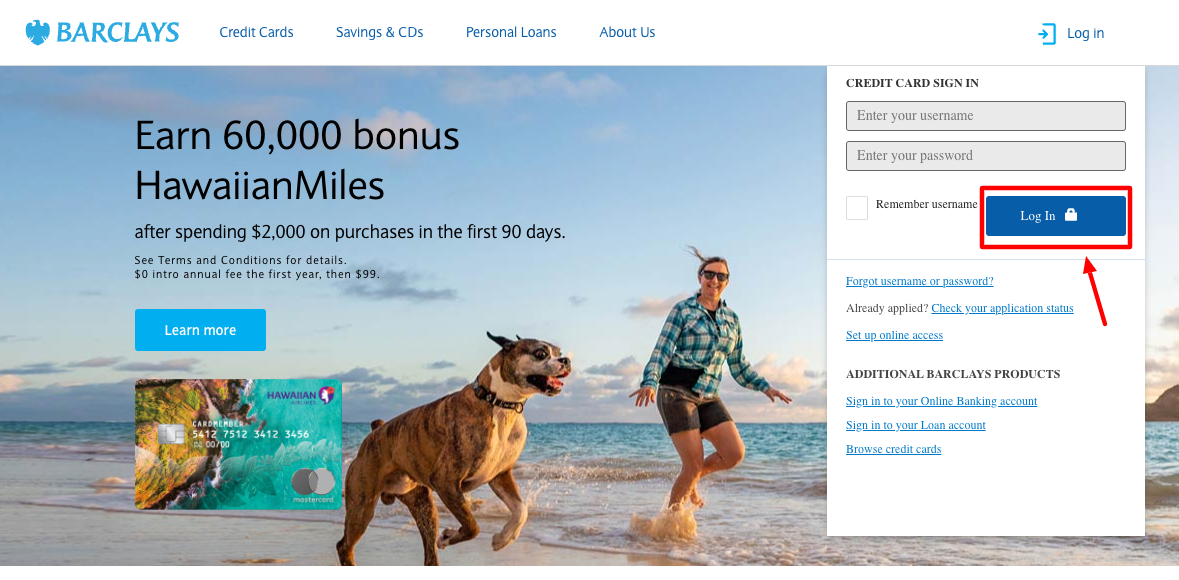

Barclay’s card Login:

- First, visit the official website of Barclay’s card www.barclaycardus.com

- Tap on the login option provided in the upper left corner of the home page.

- Enter your Login details like username and password.

- then click Remember username check box.

- Finally, tap on ‘Login to Online Banking’ to continue.

Also Read: How to Activate your Open Sky Credit Card Online

Barclay’s card password recovery:

If you’ve forgotten any of your login details then don’t need to worry about it. You need to follow these simple steps for resetting your user’s name or password.

- Visit the official page of Barclay’s credit card www.barclaycardus.com

- If you forgot your user name then you can use your 16-digit card number to log into your account.

- You will get this number on the front of your Barclaycard and on your statements.

- After logging in you have to select ‘Secure login details in the ‘Your details’ section and update your user name.

- If you forgot your password, then you have to visit the login page

- Then you have to provide your username or ID number and click ‘Next button.

- You can also use your 16-digit card number there for login.

- There you have to choose the ‘Don’t know your details?’ link under the ‘Passcode’ section.

- If you forgot your memorable word, then you have to select the ‘Don’t know your details?’ link under the ‘Memorable word’ section.

- If you forgot both your passcode and memorable word then you can choose to aby of the one ‘Don’t know your details?’ link given there.

- You have to provide your details and follow the instructions to reset your login details.

- A verification code will be sent to your mobile phone.

- If you still having issues then you can call on 0800 1661 5300(+44 1604 230 230 outside of the UK).

Barclay’s card bill payment:

You can use the Barclays website or mobile app for making a Barclays credit card payment online. You can also pay by phone, through the Barclays mobile app, by mail, or at a branch. There you can also review your statements and account balance, can set up payment notifications, and manage your card. There you can also choose how much to pay when to pay it, and where the payment is coming from.

- Online bill payment:

You’ll first need to set up online access and then log in through the site or app and set up a payment account like your savings or checking account.

- First, you have to Log in to your Barclays credit card account online.

- You can also launch the Barclays App on your mobile device.

- There you will have to choose “Payments” from the main navigation menu.

- There you have to select “Make a Payment.” Option.

- Then you will need to link an eligible checking or savings account from which to make payments.

- You have to choose the “Add a bank account” option there and provide your account details.

- Then select a payment amount from the available options there and pay the minimum amount due, the full statement balance, the current statement balance, or enter another amount of your choosing.

- You have to select a payment date, or simply select “pay now” to send your payment on the earliest date available.

- Then choose a payment account from your available bank accounts.

- After that tap on “Review and Verify” to confirm the details of your payment.

- Finally, tap on the “Pay now” to make your payment.

- You can set a payment date, amount, and payment account to be used for each automatic payment by selecting a Repeat payment option.

Payment through mail:

If you want to use a check or money order but not cash, you can mail your payment to Barclay’s. You have to put your card number on the memo or note field of your money order or check so the company applies it to the right account. You have to be sure to send it early enough that it will arrive by the due date.

Mail it to Card Services/ P.O. Box 60517/ City of Industry, CA 91716-0517.

- Call In payment:

You can make a Barclays card payment by phone using a checking or savings account which requires calling 1-877-523-0478 to reach the cardholders’ services.

The system will prompt you to give the last four digits of the card you need to pay during call and will ask for the last four numbers of your Social Security number to check that you’re the right cardmember. Then you have to confirm the information, you’ll access a voice automated system that will tell you information about your accounts such as your payment due date and minimum payment.

Then tell the automated system you want to make a payment and follow the prompts to give a payment amount and date and provide the information for the account you want to use to make a payment. At the end of the call, you will get a payment confirmation number.

Dispute a charge on Barclay’s card online:

For disputing a charge through Barclays, you have to first contact the merchant associated with the charge on your Barclays card. They can access to your purchase information and should be better able to quickly remedy the issue. You can file a dispute with Barclays if the merchant is unwilling to remedy your issue. Normally, Barclay’s dispute are typically resolved within 60 days. For this, you have to log in to your Barclays account online and search for the transaction to dispute. You can also call Barclay’s customer service at the number on the back of the card. You can also dispute a charge by mail to this given below address:

Card Services

PO Box 8802

Wilmington, DE 19899-8802

- First, you have to Log in to your www.barclaycardus.com

- Then you have to tap the” Activity and Statements” tab.

- After that find the transaction in question there.

- There you have to choose the transaction for more details.

- You have to tap “Dispute transaction” to open an inquiry.

- Finally, you have to check for a confirmation e-mail from Barclays verifying receipt of the inquiry.

Getting Started with your Barclays Card:

For starting the use of your Barclays card, you have to follow certain steps which are mentioned below. Check out these steps before activating your card.

- First, you have to activate your Barclays card.

- Then visit www.barclaysus.com/activate for set up online access. Or you have to call Barclays at 866-598-2876.

- You have to update any bill payment services for paying your credit card bill with your new account information.

- You have to set up automatic bill payments for your account. Update online merchant accounts for storing your credit card information for expedited checkouts as well as any digital wallets.

- You have to manage your account online, set up repeat payments, enroll in paperless statements for viewing your card’s features and benefits.

Lock your Barclays card:

You can instantly lock and unlock your Barclays card if lost or misplaced to prevent it from being used for purchases from its mobile app. You will also be able to set transaction limits and even block certain purchases for yourself or authorized users with its Control your card feature. Barclays app will send you notifications through which you can monitor spending and catch fraudulent purchases as soon as they happen. You just have to follow these few simple steps.

- Open your Barclays mobile app first.

- Log in with your credentials.

- You have to select the card you want to freeze.

- Then tap on the “Control Your Card” option.

- After that press the “Lock or Unlock this card” option there.

- You have to change the settings so that your card is in a locked position.

- This will stop new purchases with the card, including cash advances.

- But this will allow merchant-indicated recurring bill payments, returns, credits, dispute adjustments, payments, account fees, interest, and rewards redemptions.

- You have to navigate back to the Secure Hold page and unlock your card to use your card again.

Customer Support:

For general concerns, there is the customer support which will help you 24 hours a day, 7 days a week.

- Self-service: You just need to log in to your account, use the Barclays US app or call 1-877-523-0478 for any further help related to your card.

- Phone: You can call at these numbers mentioned below according to your problem.

- General Inquiries

(866) 928-8598

- Fax Number

(866) 823-8178

- Credit Card Activation

(877) 408-8866

- International (Call Us Collect)

1-302-255-8888

- Accessibility Coordinator

1-800-309-6191

- ADA/Accessibility Services

Please contact them using relay services (dial 711)

Reference:

-

Finance2 years ago

Finance2 years agoHow to Apply for Student Finance UK Online

-

Login Guide5 years ago

Login Guide5 years agooffice.com/verify – Signin to Download and Set up MS Office

-

Internet4 years ago

Internet4 years agowww.gaia.com/activate – Actiavtion Guide for Gaia app on your Devices

-

Login Guide2 years ago

Login Guide2 years agoHow to connect the Search console with your free WordPress account Without any Plugin in 2023

-

Login Guide1 year ago

Login Guide1 year agoHow to Access Edulastic Student Account @app.edulastic.com

-

Login Guide2 years ago

Login Guide2 years agoHow to Login to your Lifeworks Online Account