Credit Card

Kohls.com/activate – Kohls Card Activation Online

The procedure of Kohl’s card activation:

Do you want to activate your Kohl’s card? So, you are at the correct place. Have you applied for Kohl’s Card and it is in a deactivated state? The simple answer for its deactivated state is to prevent it from identity theft. You can simply activate your Kohl’s Card after 7-12 days of receiving it. Here, you can find the easiest method to activate your Kohl’s Card from Kohls.com.

About Kohl’s Card:

Kohl’s Card is a good option for the people who make purchases at Kohl’s.com regularly. It offers a 35% discount to its new cardholder on their first purchase. Kohl’s Card doesn’t charge an annual fee. More than 600 people are using this card in the U.S.

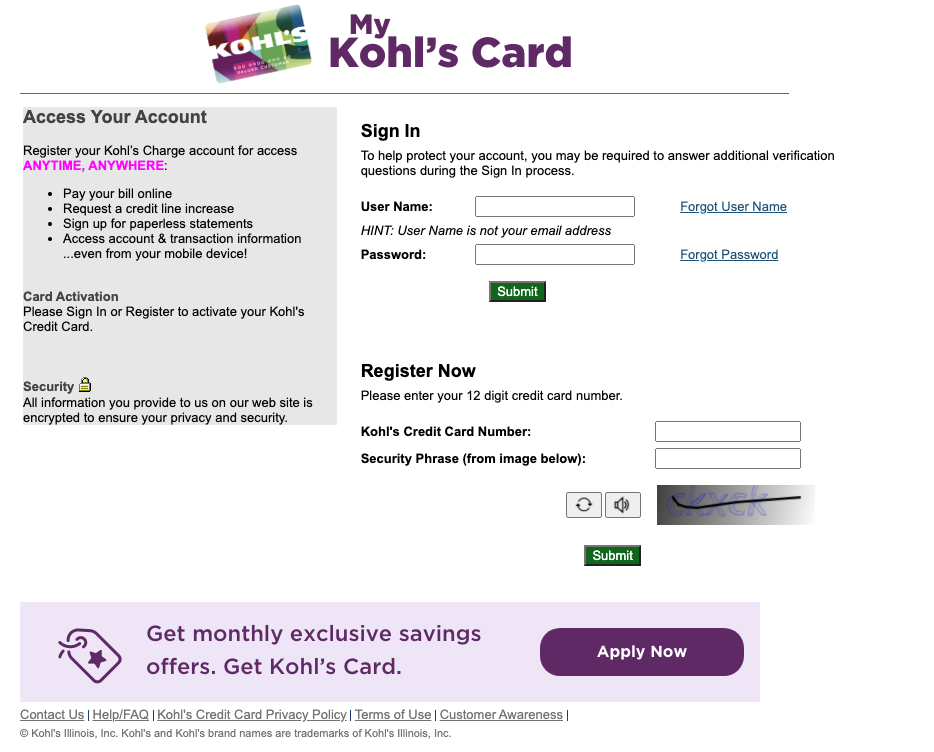

A simple guide to activating your Kohl’s Card:

Once you receive your Kohl’s card, you need to follow the steps below to activate your card, to shop online.

- Using your desktop or smartphone open your web browser.

- Visit the URL Kohls.com

- Click on “My Kohl’s Charge” in the upper right corner of the webpage.

- Click on the register now button below and enter the 12 digit number printed on your charge card and submit it, or directly go to Kohls.com/activate page.

- Create and user name and password for your account. Make sure that your password is case-sensitive, along with numbers.

- Click on submit and check your email inbox.

- Open the verification mail and click on the given link.

- Log in to your account and open the Account Summary option.

- Now click on Activate Now button.

- And make a final click on the “OK” button.

Congratulations, you have successfully activated your Kohl’s card now.

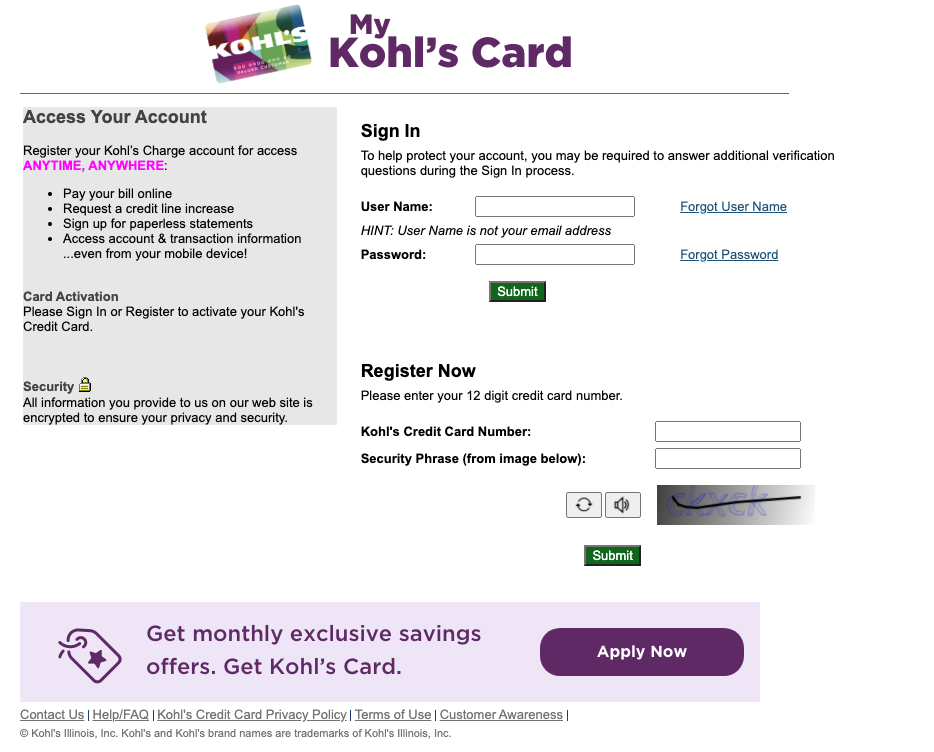

How to retrieve your Kohl’s charge User name or password?

Have you forgotten your Kohl’s charge account user name or password? Don’t worry, just have a look at the simple process shared below-

How to reset the user name of Kohl’s account?

- Visit the URL Kohls.com/activate through your web browser.

- Click on the option “Forget user name”.

- You will be redirected to a new web page called “Obtain user name”.

- Now enter your 12 digit card number and the identification code.

- Click on the Next button.

- You can now easily choose the suggested user name prompting on your screen.

Also Read: Bank of America Credit card Apply

How to reset the password of Kohl’s account?

- Go to the sign-in page of My Kohl’s card by browsing the URL Kohls.com/activate

- Click on forgot password link.

- It will redirect you to a new page Forgot your password.

- Enter the username and temporary identification code.

- Press the next button.

- Now you will receive a temporary password in your mail inbox.

- Using that password, kindly create a new and strong password for your account.

How to activate your Kohl’s card by Phone?

If you can’t activate your Kohl’s account online, you can also activate it via phone. The process is very easy. Dial the number: (800)-954-0244. Once your call gets connected, follow the instructions provided to you. Keep your social security number, charge card number. As they might ask you to enter such details during the activation process.

Your card will be ready to use once you complete the entire process on call.

Kohl’s Card Contact details:

If you need to contact Kohl’s customer support you can dial these numbers:

(855)-564-5705

Or

(855)-564-5748

You can also chat by clicking on the “Ask Us” option for any problems or queries.

Mailing address:

Corporate headquarters

Kohl’s Inc.

N56 WI7000 Ridgewood drive

Menomonee Falls, WI53051

Reference :

Credit Card

How to Activate Your Discover Credit Card

Discover credit card is known as a major credit card company that provides its cards to many individuals, students, and businesses. You will get special discounts on products along with rebates with all purchases. You can also earn reward points in case you make purchases of different types in their stores. Through this credit card, users will be able to endorse and facilitate buying stuff from a gas station.

You have to follow certain terms and conditions that apply to the credit card. Here in this article, you will get the complete details about activating the Discover credit card. So, if are planning to activate the Discover credit card then check out the complete article.

Features and benefits of Discover Card

You can enjoy the features and advantages of the Discover card after activating it on your device. Here below we have mentioned some unique features of this card that you must check out before starting the activation process.

- You will get up to $100 back if you purchase initially $200 or more in a single transaction at any [brand] store.

- You’ll receive 5 percent off on your qualifying regular transactions or orders after becoming a member that is charged to the card.

- You will get an application for your credit on anything after receiving a credit case around 24 months.

- You can access their award-winning customer service team and a $300 Tax Credit Certificate card after finishing your case.

- You will get an additional 6 months of special funding after spending $299 or more on anything in the store. This limited-time offer will help you with your student’s education.

- This card will provide you with a full 12 months to enjoy your new account with 0% financing and fixed rates for up to 20 years. This card contains no annual fees and no risk.

- You will get online access to your credit information, financial goals, online account management, and more, with flexibly scheduled payment options and no annual credit card fees 24*7.

How to Apply for a Discover Credit card

Apply for your Discover credit card by following just a few simple steps given below.

- You have to visit the official website of Discover credit card first com.

- You can also apply by calling 1-800-DISCOVER (1-800-347-2683).

- Select among cashback credit cards or travel credit cards and read their features and benefits according to your need. They also have Discover student cards and a Discover business card.

- You must be 18 or older to apply for a card.

- Then click on Apply now button just present on the right side of the card you want.

- You will be redirected to a new page.

- Fill up the form with the correct personal details required in the fields given.

- Provide accurate information about your employment and financial status.

- After submitting the bank will review the form.

- You will get a reply within 60 sec.

How to check you are pre-approved for a Discover Credit card

You have to match your financial profile is by using the card issuer’s pre-approval tool. Before applying for a Discover credit card, you have to check if you are pre-approved for a Discover Credit card. This tool will figure out the credit score for a Discover card. You just need to follow the basic steps mentioned below.

- You have to visit the Discover site first.

- You will then tap on the “All Products,” “Credit Cards,” and then “See if You’re Pre-approved.”

- You have to provide the information needed and fill out the pre-approval form.

- Finally, tap on the “Check Now” button to see your results.

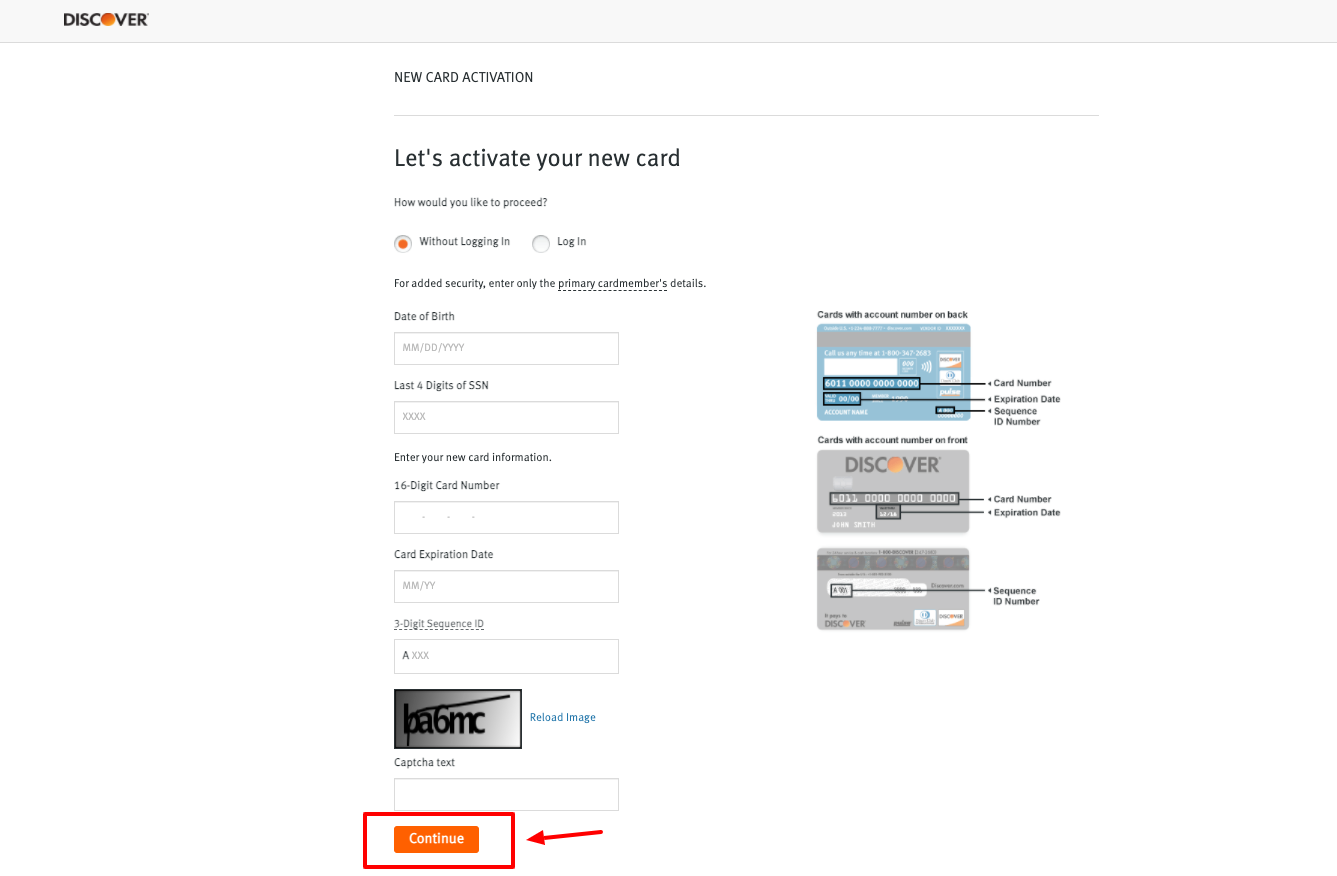

How to Activate Discover Credit Card

Online method

If you want to activate your Discover credit card through an online method then you have to visit the activation site. Then you have to provide your credit card number and the answer to a security question that was supplied when you applied for your Discover credit card. You will also provide your other personal data while making your way through the activation system. You must follow these steps to activate your card.

- Visit the activation page of Discover credit card discover.com/activate

- You must sure to carry out an online account to start this process.

- You have to tap on the “Secure Login” button.

- You will need to provide your user ID and password in the given space.

- You have to create your profile and implement the online activation process.

- After Signing in to your account, you have to press the Activate Your Card option.

- Then follow the on-screen formalities.

- Tap on the Next button and you have to provide the details like SSN, security code, and credit card number in the given space.

- You have to tap on the Next button.

- You will need to follow the on-screen activation steps.

- Press Activate your card option.

- You have completed the card activation process.

By phone

You can call the Discover Credit card customer support executive to activate your card. the process shouldn’t take more than a few minutes and you’ll be able to use your credit card immediately upon activation.

- You can call General support- 1-800-Discover (1-800-347-2683)

- You will get proper assistance and help for activating you discover credit card.

- You have to provide the card number, expiry date, CVV number on the invoice page for confirming the account details.

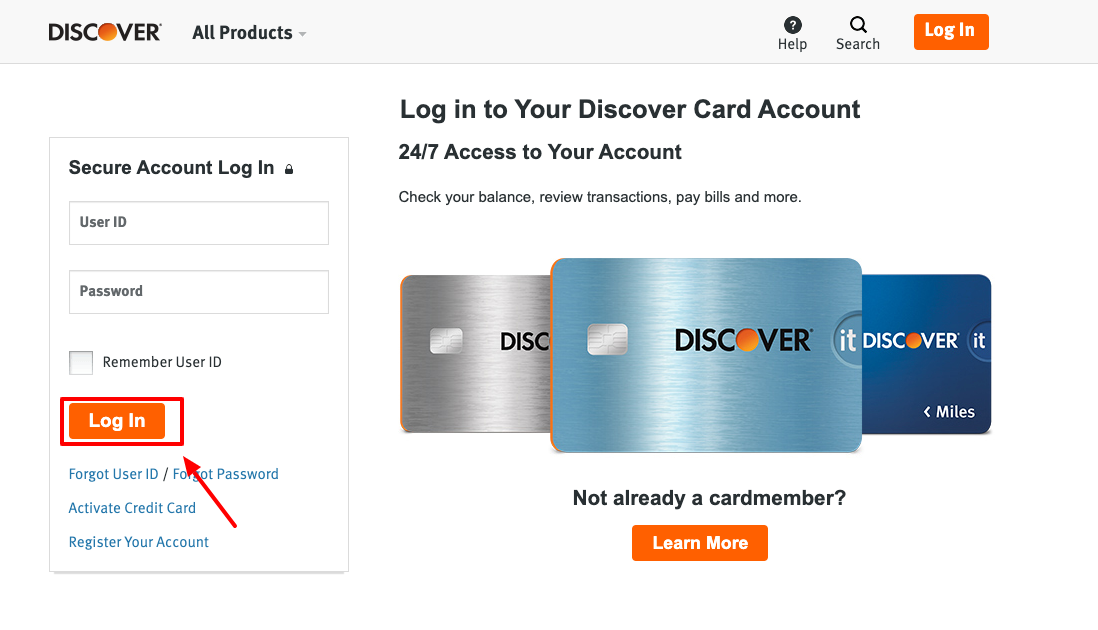

Discover Credit card Login

If you want to log in to your online account of Discover credit card then follow the steps mentioned below.

- First, visit the official login page of Discover Credit card portal.discover.com

- Provide your user’s name and password to the mandatory fields given.

- Click on the login option.

Recover Login information for Discover credit card

If you have forgotten the user id or password then don’t need to worry. You can get access to your online account again by following these simple steps.

- Visit the official login page of Discovery Credit card portal.discover.com

- Click on the link, ‘Find User ID’ or ‘Reset Password’.

- You will find these options under the ‘Secure Login’ section.

- You have to provide your Account ID card Number in the given place.

- Then provide your Billing Zip Code there.

- Then you have to enter the User ID and Zip code in the given space.

- Then tap on the “Find User ID” or “Continue” button to complete the recovery process.

Discover Credit card bill payment

You can make your bill payments through online banking, mobile app, on-call, or mail also.

Online bill payment

- First, you have to visit the login page of Discover Credit card portal.discover.com

- Then provide your user id and password.

- Click on the sign-in button.

- Once you have logged in to your account click on the bill pay option.

- Then you have to choose how much you have to pay.

- Then select when you want to pay.

- Add a person or company you want to pay.

- Click on making payments.

Through Mobile app

- You can text APP to DISCOV (347268) to download the app to your phone.

- Open the app on your android.

- Login to your account using your user id and password.

- You have to select your card.

- Click on the make a payment option.

- You can also pay your bill through the online bill pay service from your bank account.

Payment through mail

If you want to make your payment through mail then you can send a Mail in your payment with the payment coupon on your statement.

You have to send it early enough that it will arrive by the due date.

- Call In payment:

You can Call 1-800-DISCOVER (1-800-347-2683) and enter your card information when prompted.

- Payment at branch:

You can easily make your payment by visiting any Discover credit card branch during normal business hours.

Reference:

Credit Card

www.surgecardinfo.com – Manage your Surge MasterCard Online

The Surge MasterCard is a credit card designed for those with limited or damaged credit. Celtic Bank, the card’s issuer, considers applicants with substandard credit. But, unlike most cards aimed at the subprime market, it is not a secured card and no upfront security deposit is needed upon approval. The card’s servicer, Continental Finance, reports your payment history to all three credit bureaus, which allows cardholders to build credit with responsible use.

The Surge MasterCard Credit Card can help you achieve your goal of improving your credit history, but it will cost you. The card could come with a high annual fee, depending on your creditworthiness. Along with that potentially high annual fee, the card is equipped with a monthly maintenance fee beginning with your second year as a cardholder.

Features of Surge MasterCard:

- See if you’re Pre-Qualified with no impact to your credit score

- All credit types welcome to apply

- Up to $1,000 credit limit doubles up to $2,000! (Simply make your first 6 monthly minimum payments on time)

- Free access to your Vantage 3.0 score from Experian (When you sign up for e-statements)

- Monthly reporting to the three major credit bureaus

- Fast and easy application process; results in seconds

- Use your card at locations everywhere MasterCard is accepted

- MasterCard Zero Fraud Liability Protection (subject to MasterCard guidelines)

- Checking Account Required.

Fees of Surge MasterCard:

- Annual Percentage Rate is 24.99% to 29.99%

- APR for Cash Advances is 24.99% to 29.99%

- Annual Fee is $75.00 to $99.00

- Monthly Maintenance Fee is $0 to $120.00 annually

- Additional Card Fee

is $30.00 - Cash Advance is either $5.00 or 5%

- Foreign Transaction fee is 0 to 3%

- Late Payment is up to $40.00

- Returned Payment is up to $40.00

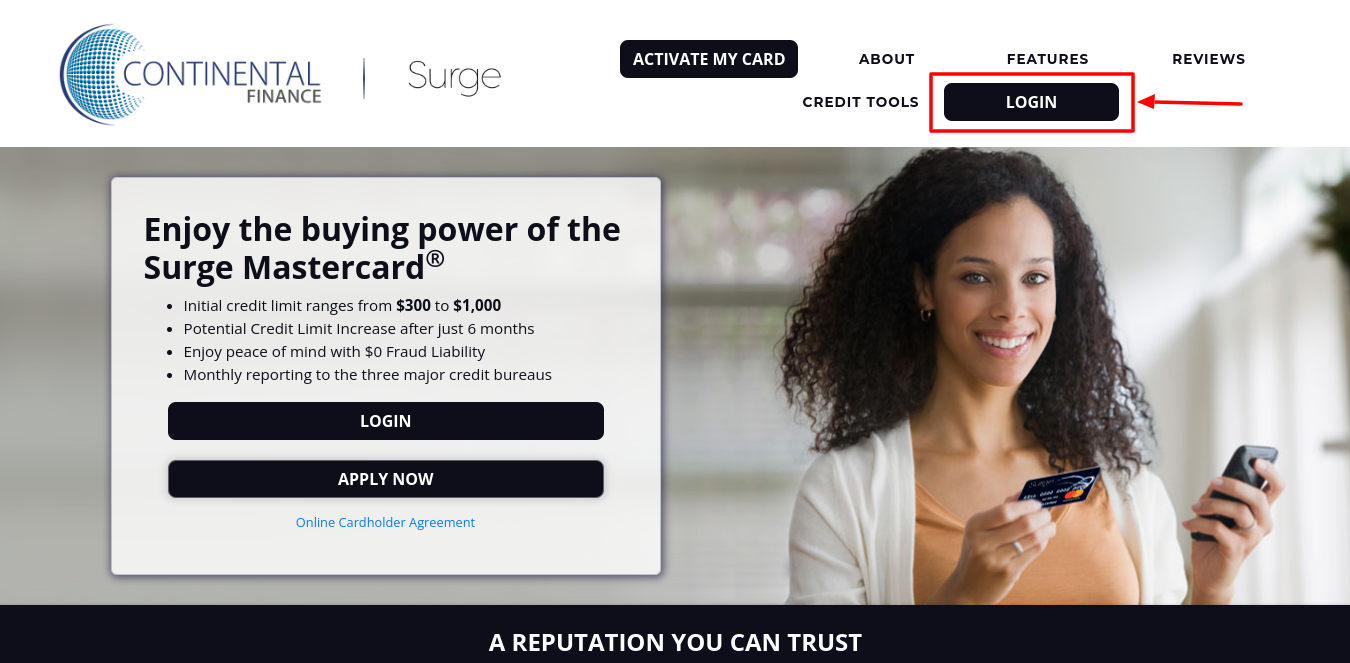

Login to your Surge MasterCard Account:

- For the login open the page www.surgecardinfo.com

- Next at the upper right side of the page click on ‘Login’ button.

- Add the username, password hit on ‘Login to my account’ button.

How to Recover Surge MasterCard Login Initials:

- To retrieve the login initials go to the webpage www.surgecardinfo.com

- In the login section hit on ‘Forgot username or password?’ button.

- Choose your issue and proceed with the prompts.

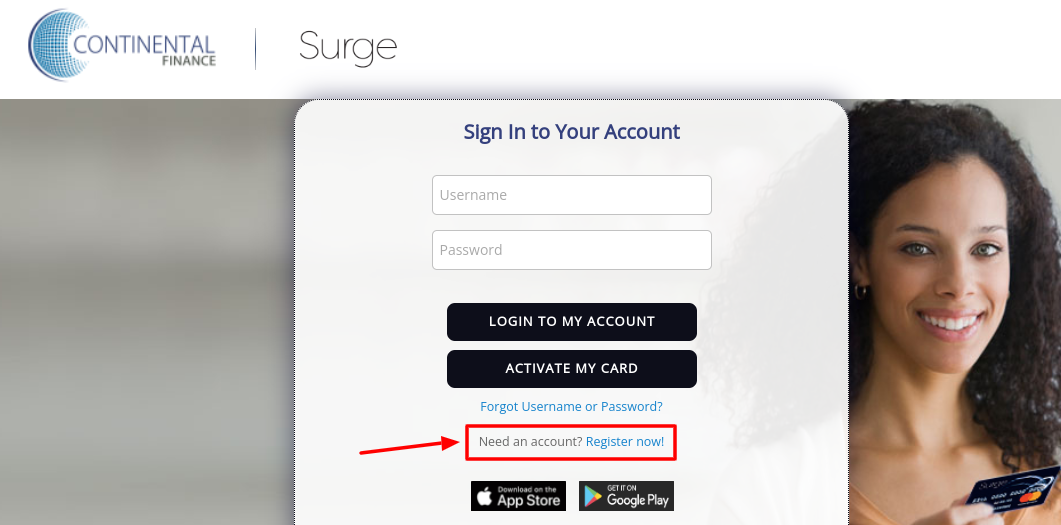

Register for Surge MasterCard Account:

- To register for the account visit the website yourcreditcardinfo.com/?product=surge

- Secondly go to the login section and click on ‘Need an account? Register now!’ button.

- Enter the last four numbers of the credit card, SSN, zip code click on ‘Lookup account’ button.

Activate your Surge MasterCard:

- To activate the account use the link www.surgecardinfo.com

- Go to the login section and click on ‘ACTIVATE MY CARD’ button.

- Enter the last four numbers of the credit card, SSN, zip code click on ‘Activate my card’ button.

Apply for Surge MasterCard:

- To apply for the card visit the web address www.surgecardinfo.com

- At the center left side of the page click on ‘apply now’ button.

- Add your first name, middle initial, last name, suffix, home address, address 2, city, state, zip code, email address, social security number, and your total monthly income. Calculate your monthly income.

- Now enter Primary Source of Monthly income, Primary phone number, Secondary phone number, Date of Birth, answer some questions, certify you are at least 18 years old, agree to the terms, and check the verification box.

- Now click on ‘See my card offers’ button.

Also Read:

How to Activate and Login your Barclay Credit Card

How to Manage your Barclays Credit Card Account

Guide to Manage your Discover Credit Card Account

Surge MasterCard Bill Payment by Phone:

- You can also pay your Surge Credit Card bill by phone, at (866) 513-4598.

- Phone payments can be made from 7 am to 10 pm ET Monday to Friday, and 8 am to 4 pm on Saturday.

Surge MasterCard Bill Payment by Mail Address:

- Surge card payments can also be sent by mail. Mail a check, along with the payment coupon from your monthly statement, to:

- Surge Card. P.O. Box 6812. Carol Stream, IL 60197-6812

Frequently Asked Questions on Surge MasterCard:

- How to Check the Status of Your Surge Credit Card?

To check your Surge Credit Card application status, call the backer’s client support division at 866-449-4514. There is no internet based instrument to really look at your application status.

- What Credit Card Is Continental Finance?

The Cerulean MasterCard is one of a couple of charge cards by Continental Finance and is given by Bank of Missouri.

- What Bank Is Surge Credit Card?

Celtic Bank the Surge MasterCard is given by Celtic Bank and is made for restricted or awful credit. Whenever you utilize this card, your installment action will be accounted for month to month to the three significant credit departments, which can assist you with building credit.

Surge MasterCard Customer Support:

For more support call on the toll-free number 1-866-513-4598.

Reference Link:

yourcreditcardinfo.com/?product=surge

Credit Card

barclaysus.com/activate – How to Activate and Login your Barclay Credit Card

The Wyndham Prizes Worker In addition to Card gave by Barclays is intended for voyagers who invest a ton of energy out and about and have proclivity for remaining at one of Wyndham’s 9,000 properties en route. It accompanies a liberal invite reward that could get your engine running, worth a few evenings at lower-level lodgings. The card procures a similarly liberal 6 points per dollar on Lodgings By Wyndham and gas buys, 4 points per dollar on cafés and basic food item buys and 1 point for every dollar on any remaining buys.

Besides, the card accompanies programmed Platinum status, a 10% focuses markdown while booking free evenings and no unfamiliar exchange charges, for a moderately low yearly expense of $75.If you every now and again stay at Wyndham lodging brands like Wyndham, TRYP and La Quinta, the Wyndham Prizes Worker In addition to Card could be a compensating expansion to your wallet.

Popular Barclay Credit Cards:

- Barclaycard Arrival Plus World Elite MasterCard

- Wyndham Credit Card

- Barclaycard Ring MasterCard

Barclay Wyndham Credit Card Features:

- Earn 45,000 extra focuses, enough for up to 6 free evenings at partaking properties, in the wake of expenditure $1,000 on buys in the initial 90 days. Resort charges might apply

- Acquire 6 focuses per $1 spent on Inns by Wyndham and gas buys

- Acquire 4 focuses per $1 spent on cafés and staple buys

- Acquire 1 point for every $1 spent on any remaining buys

- Get Wyndham Prizes PLATINUM participation, which remembers early check-for, vehicle rental updates and that’s just the beginning

- Get 7,500 extra focuses every commemoration year

Barclay Wyndham Credit Card Rates:

- APR is 15.74% to 24.99% variable

- Intro APR is 0% promotional APR for 6 billing cycles on all Wyndham Timeshare Purchases

- Intro APR on Balance Transfer is 0% introductory APR for the first fifteen billing cycles following each balance transfer that posts to your account within 45 days of account opening.

- Annual Fee is $75

- Balance Transfer Fee is either $5 or 3% of the amount of each transfer, whichever is greater

- Cash Advance Fee is either $10 or 5% of the amount of each cash advance, whichever is greater

- Foreign Transaction Fee is 0% of each transaction in U.S. dollars.

Activate Your Barclay Credit Card:

- Open a new tab in the browser and enter URL barclaysus.com/activate in the address bar

- At the center left side of the page click on ‘Activate my card now’ tab.

- Add Last 4 digits of your social security number, Date of birth, Account number, Security code, Occupation, specify if you are a United States Citizen?

- Now click on ‘Continue’ button.

- Now follow the page instructions after this and complete the activation.

Login to your Barclay Credit Card Account:

- Copy and paste the URL barclaysus.com/activate in the browser search box. Then hit enter.

- Next at the center add a username, password

- Now click on ‘Log in’ button under the login boxes.

Retrieve Barclay Credit Card Login Information:

- If you have forgotten the login details go to the webpage barclaysus.com/activate

- Visit the login page. Click on ‘Forgot username or password’ button below the login boxes.

- Enter last four numbers of social security, date of birth, account number and you have to hit on ‘Continue’ button.

Apply for Barclay Credit Card:

- There are various credit cards offered by Barclays. Here check out the application of Wyndham Credit Card

- To apply for the card use this link barclaycardus.com

- Hit on ‘Credit cards’ tab at top left side of the screen. Scroll down and choose Wyndham Credit Card. Click on ‘Learn more’ button at the right side of the card image.

- Next at the upper right side of the page click on ‘Apply now’ button.

- Enter general information, employment and financial details, contact information, check the paperless statements, enter the skyward membership number, add an authorized user, read the terms.

- Now click on ‘Apply’ button at the bottom right side of the page.

Barclay Credit Card Bill Pay by Phone:

- To pay by phone, can call on the toll-free number 1.877.408.8866.

- You must have your credit or debit card, and the billing initials.

Also Read:

Activation guide for North Lane Wirecard Online

Access to your Victorias Secret Credit Card

Guide to Manage your Discover Credit Card Account

Barclay Credit Card Bill Pay by Mail:

- To make mail payment, post the money order or check to, P.O. Box 60517. City of Industry, CA 91716-0517.

- You will get reply from the card center within 3 to 5 business days.

Barclay Credit Card Bill Pay by Mobile App:

- You can download Barclays mobile app and use it to register your card

- The app is also helpful for other card activities.

Frequently Asked Questions on Barclay Credit Card:

- How to Activate You Barclay Card?

Simply log in, tap ‘Barclaycard’, and activate your card you’ll need your new Barclaycard to hand. If you haven’t got either you can download our free app at App Store or Google Play you’ll need your credit limit and new card to start using it.

- How to Activate Your Jetblue Card?

To activate a new JetBlue MasterCard online, visit the Barclays credit card activation website. Activate over the phone. Call 1-877-408-8866 to activate your JetBlue MasterCard over the phone.

- How to Pay Your Barclay Credit Card Online?

When making a payment from Barclaycard online servicing, select ‘Payments’ in the main menu. To register for or log into Barclaycard online servicing, click here. When making a payment from the Barclaycard app, simply select ‘Make a payment from the main menu. You can set up automated payments using a Direct Debit.

Barclaycard Credit Card Customer Help:

For more help options call on 866-928-8598.

Reference Link:

-

Login Guide3 years ago

Login Guide3 years agooffice.com/verify – Signin to Download and Set up MS Office

-

Internet2 years ago

Internet2 years agowww.gaia.com/activate – Actiavtion Guide for Gaia app on your Devices

-

Login Guide9 months ago

Login Guide9 months agoHow to connect the Search console with your free WordPress account Without any Plugin in 2023

-

Login Guide11 months ago

Login Guide11 months agoHow to Login to your Lifeworks Online Account

-

Login Guide3 years ago

Login Guide3 years agowww.ups.com – Steps to Access UPS Account

-

Finance11 months ago

Finance11 months agoHow to Apply for Student Finance UK Online

-

Login Guide11 months ago

Login Guide11 months agoAccess to your My HealtheVet Login Account

-

Login Guide11 months ago

Login Guide11 months agoSteps to Access your My Care Plus Login Account